Banking and finance are not the freshest industry in the field of development. Banking is the oldest of the industries which are developing day-by-day. Everybody understands that taking a loan from the bank is a very long and restless process. Filling out the application for a loan giving the right document the verification it’s a tremendous process which sometimes takes days. But, when there is a “but” involved then there is something new and hopeful. Banking Applications are being developed which are very helpful in the banking sector.

The banking industry is bringing a bigger and better revolution in the world. The adaptability this kind of application provides not only helps the bank operatives but also the bank customers which on the other hand can simply request for anything through the application. Now form filling is not a difficulty anymore, you don’t require to be in the line for getting your work done its all getting digital these days. People who are aged and can’t forth stand in banks can also use these applications to get their work done.

The applications of these kinds give end-to-end solutions like any kind of application support, provides the user information about the loan eligibility, documentation, etc. at a single place.

How Does It Work?

These type loan applications open many opportunities for the loan borrowers which sometimes consist of private institute loans, personal loans. Through these applications, people can lend some money as a loan as money lenders. Bankers on the application can easily lookout for the loan offers to invest in also known as (LIP). The bankers can get in touch with the borrowers for concluding the lending proposal. There is a whole process behind this the borrower will have to present the loan application which is then reviewed and approved by the admin to complete the security check. The borrowers can simply maintain the list of loan applications through the Loan lending application.

Benefits of this Application

There are many ways and cases in which these loan lending applications can be profitable for the customers and businesses both.

Some of the benefits that we get from Loan Lending Applications are:

- Security of Application: Security in the application is a must by building a stronghold password and keeping it to yourself and private. These sorts of applications use an encrypted route that keeps the application data safe.

- Loan variety: There are many types of loans on the loan lending application like personal loans, and payday loans are available on the application for the users. Many users look for various types of loans and this application keeps the records and care for its users.

- Loan Application: A very easier way to file for a loan on the loan lending application that will affect the loan lenders to get the loan from them.

- Confidentiality: Some of the users need the loan for a particular reason and they don’t want that the reason should not be out and be confidential; there is an option for that in the application of privacy and confidentiality.

- Navigation: It’s very simple for the lenders to evaluate all the applications and select their borrower which befits their conditions of the loan.

- Messaging: Lenders can review their terms of the transaction with the borrowers after the borrowers have viewed the list of loans.

- Management of Application: Borrowers can handle all their loans and the money lenders on the application as the application made this very easy for the borrowers to manage all that on a single go.

Why they use your Money Lending Application?

Well if you have made up your mind on developing a Money Lending Application for your customers then what should be your next step-

There are many points which needed to be taken care of to make your app popular among users like,

Security & Safety

The Documentation method which takes place between the borrowers and lenders is safe and secure in the application as the application is encrypted and all the data in the application is classified.

Paperwork

Well, you are already going through a lot of processes on the application on your mobile phone which itself reduces the user of paperwork and fastens the entire process of getting a loan.

Accountability

Trust is the basic need of all the users when it comes to loan lending as the users look for the most trustable companies. Users look and cross-check the data provided by the companies n their websites and once the users get the trust and accountability of the company then they begin the process.

Loan Lending Application Features:

Loan Lending Application User Panel Feature:

- Registration: Users can register themselves on the application by providing the personal information asked on the registration page in the application.

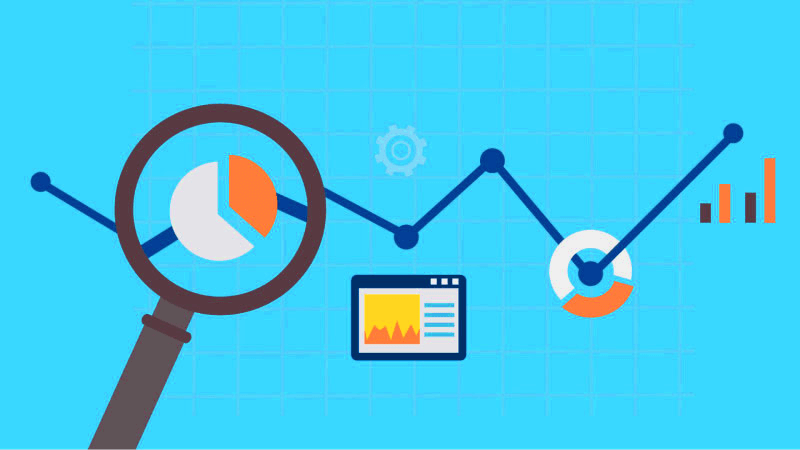

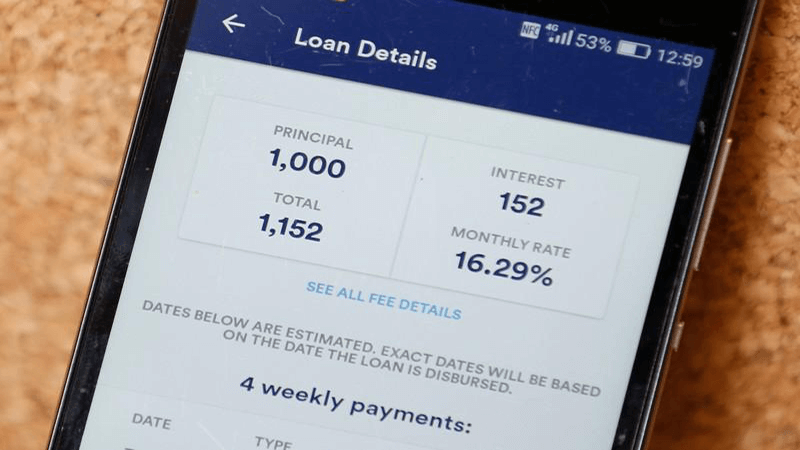

- Apply for the Loan: User can also apply for the immediate loan, for applying the loan a user need to follow the few steps like choosing the amount of money they need, EMI of the amount they are lending and will need to pay, GST they have to pay, and the processing fee to finish the fund transfer.

- Calculation Tool for EMI and Interest: This is an inbuilt feature in the application which enables the user to view the amount of EMI or interest they will be paying on a particular amount of money.

- Payback Period Setting: The users have the access to decide when to payback, and as per the payback period the user decides to pay the EMI. The Interest will be shown and displayed to the user.

- Transactions: This feature in the application will show the user the complete history and summary of the money borrowed the amount of Withdrawal and available credit limit.

- Support: It allows the user to contact for any query with the support team through the application support.

Loan Lending Application Admin Panel features

- Login: The admin can log in to the admin dashboard by the login credentials.

- Profile Approval: Admin verifies and checks the user-profiles and the data provided by the users like the User PAN, credit card or debit card details, etc.

- Managing Users: Admin can manage the users as if the admin found that the user is breaking the terms and condition of the application admin can block the user account or may delete it.

- Manage the Earning: Admin is responsible for managing the earning of the user’s admin can view the complete earning of the users, income and any pending money if they have.

- Manage Profile: Admin is accountable to manage the user profile, and the admin can choose to add/delete/remove the user profile.

- Loan Management: Admin can manage the loan types that the user has selected as the terms & conditions, the interest rate may vary for all the types.

Development Process of Loan Lending Application

The process of Developing a Loan Lending Application involves

- Planning: The beginning of an application development process starts up with the planning of the application and what method is to be used to make it successful.

- Research & Development: Research & Development usually assists in finding the right amount of data about the application or the industry you are developing your application under.

- Design & Development: The Design of an application is the essential aspect of an application, the design of the application makes the application user-friendly and it’s one of the greatest ways to improve the user experience as well. Design your application in a way that the user is forced to open the application again & again & is simple to use & control.

- Testing: The testing of the application before the deployment of the application is better because that is when you can fully test your application and find the bugs if there are any and can dispose the application as per the client demand.

- Support & Maintenance: It is one of the important features of app building process after the deployment of an application it is one of the major aspects which gets the users bounded to use it provides the support and maintenance after the deployment of the application providing updates to the application solving and providing the support to the application users is one of the major points.

Cost Of Development

Mobile Application Development has its own cost based on the number of features and functions attached to it. There are many factors on which the cost of developing an application depends, Such as the development region, app features, app platforms, and many more.

The cost of development mainly depends upon the region where the application is developed. Also, Shown below is the per hour cost of the application development:

- USA: $50-$100/hr

- Western Europe: $50-$200/hr

- Australia: $40-$150/hr

- Asia: $10-$60/hr